The global payments ecosystem is undergoing a seismic shift, fueled by surging customer expectations for immediacy, burgeoning regulations, and an ever-expanding array of payment channels.

While much has been written about the technology side of this transformation (e.g., the real-time payments infrastructure, faster payment rails, and open banking interfaces), the Business Process Services (BPS) dimension deserves equal attention.

Payment’s enterprises—from issuing and acquiring banks to PayTechs and card networks—are increasingly looking to BPS providers as strategic partners to help them navigate complexity, tame operational costs, and power new revenue streams.

This blog, the first of a three-part series, examines the broader demand themes that are shaping the Payments BPS market. Specifically, we explore the ongoing boom in real-time payments (RTP) and how the payments value chain (when viewed through a business process lens) is yielding new opportunities to outsource.

We close by asking the core question on all executives’ minds: How can enterprises sustain the operational demands of RTP while driving efficiency and innovation at the same time?

Reach out to discuss this topic in depth.

Real-time payments: The accelerant of change

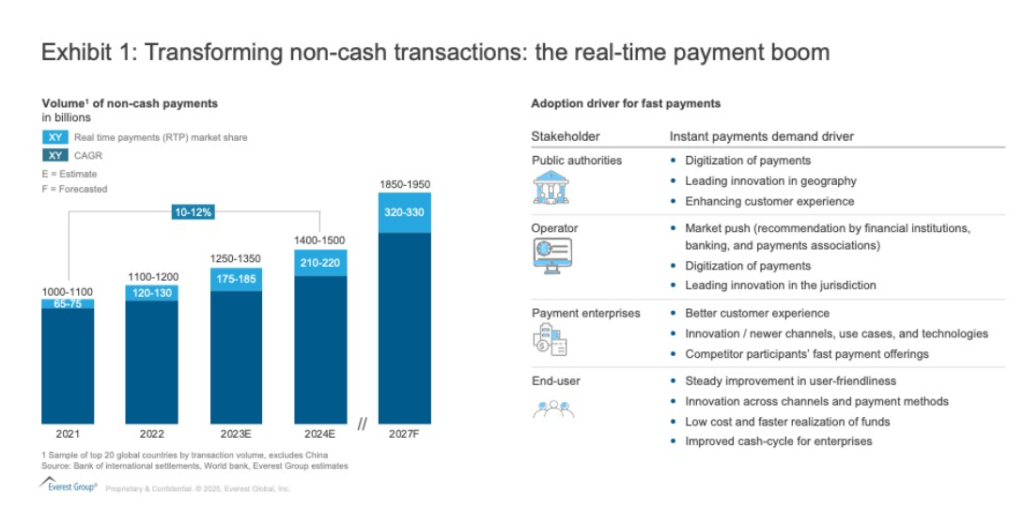

Real-time payments have moved from a niche offering to a mainstream expectation in many markets. As shown in Exhibit 1, RTP volumes are expanding at double-digit rates, spurred by a consumer demand for instant fund availability and enterprises’ pursuit of faster settlement cycles. Even traditionally cautious public authorities—such as central banks—are issuing or expanding real-time payment rails to drive financial inclusion, efficiency, and innovation.

Exhibit 1: Transforming non-cash transactions: the real-time payments boom

This RTP surge has two major implications for BPS:

- First, the urgency, increased volume, and complexity of compliance, fraud management, and dispute resolution processes intensify in a real-time context, making it more attractive to outsource these tasks to specialists with proven scale and robust tools

- Second, real-time processing often requires 24/7 operational support with enhanced customer experience (CX), a service continuity challenge that BPS providers are well-positioned to handle with global delivery models

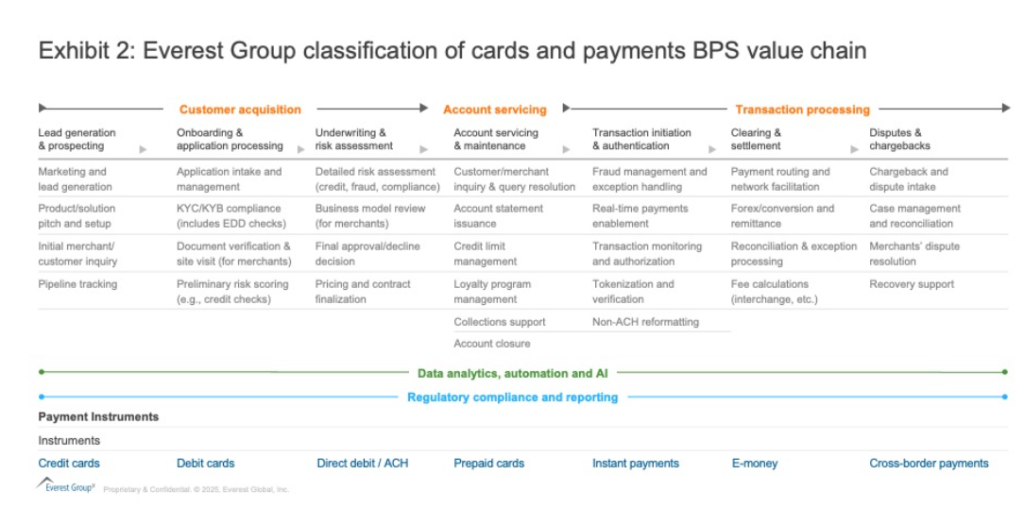

Mapping the complex payments BPS value chain

Exhibit 2 reveals the core processes that payments enterprises can consider for outsourcing—from lead generation and underwriting, through to transaction processing and dispute resolution. By referring to this modular view, payments enterprises can selectively outsource processes that carry the highest cost or risk—or that require specialized domain knowledge.

As real‐time payments grow in volume, mid‐ and back‐office operations (e.g., underwriting, chargeback resolution) are expected to see a disproportionate uptick in the demand for outsourcing. This trend is fueled by the desire for operational flexibility and variable cost structures, while simultaneously managing compliance complexities.

Exhibit 2: Everest Group classification of cards and payments BPS value chain

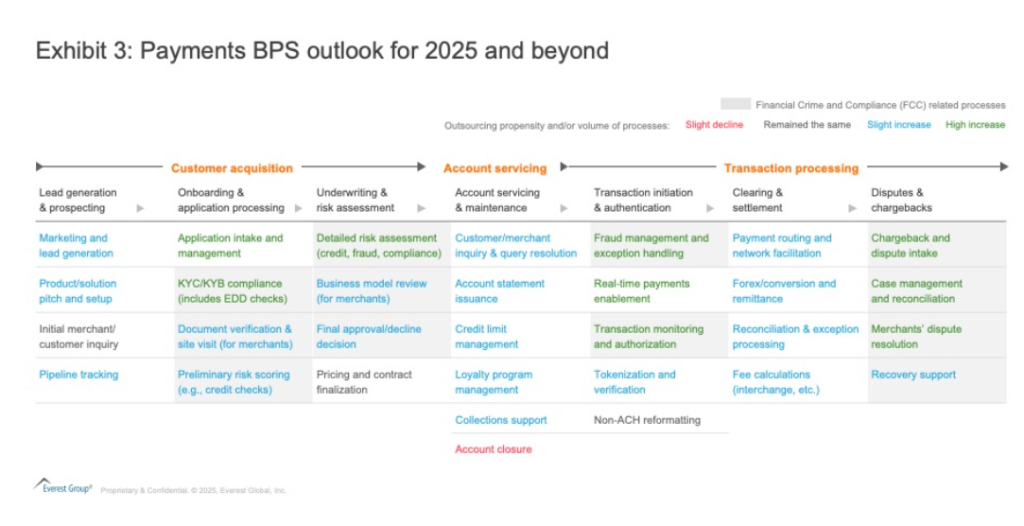

Increasing propensity to outsource across the payments BPS sub-processes

As shown in Exhibit 3, the demand and growth potential for Payments BPS is not just limited to Financial Crime Compliance (FCC), CX, or a tech overhaul. There are nuanced processes across the value chain—such as lead generation and prospecting, account servicing and maintenance, and clearing and settlement —that are poised for higher traction in the coming years.

Exhibit 3: Payments BPS outlook for 2025 and beyond

Several market forces are converging to increase the likelihood that payments enterprises will look outward for operational support:

- Cost and complexity

Real-time payments add layers of fraud checks, compliance obligations, and data management. With regulations tightening and consumer expectations rising, many organizations find it more cost-effective to plug into an existing BPS ecosystem, than to scale these functions in-house.

- Continuous innovation

The technology stack for modern payments is evolving at a breakneck speed. BPS providers, especially those with global footprints and co-innovation models, can help organizations quickly pilot and implement new solutions, enabling them to keep pace with FinTech and BigTech disruptors.

- Focus on core competencies

Payment enterprises that see themselves primarily as product innovators or Customer Experience (CX) leaders prefer to divest non-differentiating operations—such as routine merchant onboarding or dispute processing—to specialists.

- Global reach

As banks, PayTechs, and other payment firms expand across borders, they need round-the-clock support with language capabilities and knowledge of local payment regulations. BPS providers—particularly broad-based ones—can deliver the necessary scale, language support, and compliance frameworks.

Looking ahead

This is the first of three blog posts exploring how the Payments BPS market is evolving. Having established the macro drivers—real-time payments growth, an expanding buyer pool, and the rising propensity to outsource—our next blog will take a closer look at which emerging buyer segments and verticals are fueling this demand, and how their needs are shaping BPS requirements.

From FinTechs to retailers and healthcare providers, we are seeing a wide range of new entrants to the payments space, each with unique outsourcing patterns.

Finally, our third blog will spotlight how BPS providers are altering their go-to-market strategies to meet these challenges—either by augmenting operations with technology and advisory capabilities or by forging strategic partnerships.

For now, it is clear that the Payments BPS landscape is rife with opportunity for both buyers and providers, who can effectively align their strengths with the evolving demands of an always-on, real-time payments world.

To explore payments trends in detail, read our latest report:

If you found this blog interesting, check out our Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group , which delves deeper into another topic regarding the banking sector.

To speak with our payments BPS experts or schedule a call, reach out to: Ronak Doshi ([email protected]), Suman Upardrasta ([email protected]), Ritwik Rudra ([email protected]), and Rahul Mittal ([email protected]).

Stay tuned for the launch of our inaugural Payments Operations Services PEAK Matrix® Assessment 2025 next quarter.