Wiz: The story of one of the hottest cyber upstarts

Founded by the team that led Microsoft’s cloud security group, Wiz emerged from stealth mode in the middle of the pandemic in December 2020. From its inception, Wiz had set itself on the mission to secure the cloud, which was rightly aligned with the ongoing market demands of cloud transformations in the pandemic era.

Reach out to discuss this topic in depth.

Wiz envisioned to be the singular cloud security platform across multiple clouds, covering vulnerabilities, configurations, network, and identity issues. Wiz’s approach to cloud security includes

- Comprehensive multi-cloud security: Excels in offering cloud visibility across different clouds – AWS, Azure, and Google Cloud, making it ideal for today’s organizations with multi-cloud environments

- Agentless architecture: Employs an agentless security model, which provides seamless visibility across cloud environments without the overhead of deploying agents, thus making plug-and-play easy giving enterprises scalability and flexibility

- Security Graph: Wiz’s Security Graph provides deep, context-driven insights to prioritize risks based on their business impact

- Single cloud security platform with runtime protection: Cloud security is broken with multiple point tools – CSPM, CNAPP, CWPP, CIEM, CDR, and vulnerability management etc. Wiz’s cloud security platform offers all the above multi-tool functionality from a single platform. Further, it is distinguished by its combination of runtime protection alongside cloud-native security posture management (CSPM), offering a more holistic cloud security

- Focus on developer experience: Designed with a developer-friendly approach, helping security and development teams collaborate effectively

Enterprises that have used Wiz’s platform find it to be:

- Simple and user-friendly offering greater flexibility

- Appreciate the real-time visibility into their cloud environment across infra, network, identity, and data layers for multiple cloud – AWS, Azure, and Google Cloud

- Single-pane glass platform to secure the cloud

Wiz has remained a darling of the investors primarily driven by Wiz’s strong growth in its annual recurring revenue (ARR). It hit US$100 million in ARR after 18 months in August 2022, achieved $350 million in ARR in 2023, and US$500 in ARR in 2024 making it one of the hottest cyber upstarts.

Google – Wiz: The story of persistent pursuit

Back in 2024, Wiz declined Google’s US$23 billion acquisition offer, citing strong growth momentum and market positioning. Wiz must have felt a greater potential in operating independently as it was expanding rapidly, securing major enterprise clients, and rapidly increasing its Annual Recurring Revenue (ARR). At the time, Google was still focused on integrating its earlier Mandiant acquisition, and the timing for another large-scale investment may not have been optimal.

Now in 2025, circumstances have shifted. Google returned with a US$32 billion offer, reflecting a stronger strategic intent. The scale of investment stands out, as Google is acquiring Wiz at one of the highest revenue multiples ever seen in cybersecurity Mergers and Acquisitions (M&A) history. With Wiz’s estimated revenue hovering around $700 million, the deal’s revenue multiple falls between 45-65x, making it comparable only to Okta’s acquisition of Auth0 in 2021.

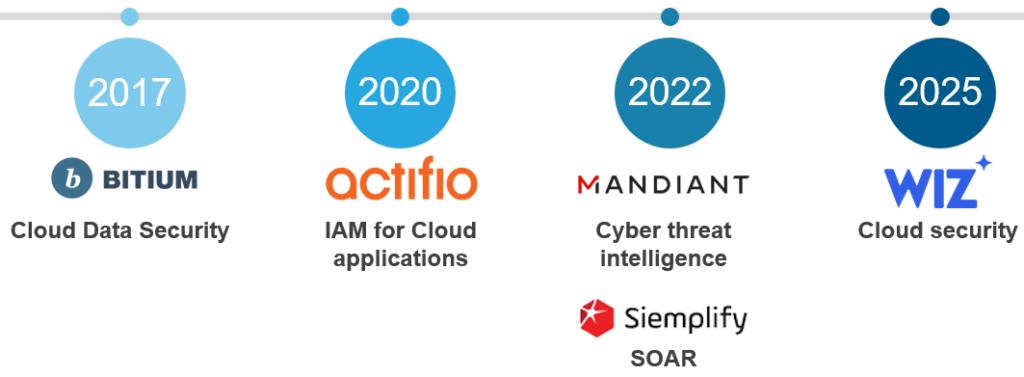

Google’s acquisition of Wiz aligns with its broader strategy of strengthening its cybersecurity portfolio through targeted, segment-specific investments. Over the years, Google has pursued inorganic growth in cybersecurity, acquiring companies that address distinct areas of cybersecurity.

Timeline of Google’s security-focused acquisition

By adding Wiz to its portfolio, Google is now solidifying its position in cloud security, a segment that has become increasingly vital as organizations migrate workloads to multi-cloud environments. Google’s move to acquire Wiz signals an intent to provide an integrated, security-first approach to cloud adoption, reducing the friction organizations face when securing diverse cloud environments. This acquisition also enhances Google’s competitive positioning against AWS and Microsoft Azure, both of which have been investing heavily in cloud security solutions to cater to enterprise demand.

We believe, on a larger level, Alphabet’s US$32 billion bet on Wiz is not just about cybersecurity—it’s a strategic move to future-proof Google Cloud as its core ad business faces increasing uncertainty from artificial intelligence (AI)-driven search disruption, regulatory crackdowns, and shifting digital advertising models. As search and ad revenue becomes less predictable, Google is doubling down on cloud and enterprise security as a long-term growth engine, ensuring it remains critical to enterprise Information Technology (IT) strategies even if its dominance in consumer search weakens.

What comes next?

Wiz and Google Cloud will now have to sort out regulations and compliance requirements. Big tech acquisitions often attract antitrust reviews. It is anybody’s guess how that will play out given the current geopolitical environment in the U.S.

In the European market, where Google (Alphabet) is already engaged in multiple courtroom fights with authorities over antitrust violations and data privacy concerns, the acquisition could attract scrutiny from European Union (EU) regulators. The expected prolonged process gives much-needed time for the stakeholders to evaluate the implications of such an acquisition. Here is a deep dive into what they should anticipate:

- Enterprises: Current and potential customers of Wiz and Google Cloud

Potential benefits:

- Accelerated innovation roadmap of the product pipeline of Wiz, with Google’s access to a considerably larger pool of resources

- A stronger Google Cloud security portfolio as native integration with Wiz will improve visibility and compliance controls

- Deeper AI-driven threat detection as Wiz will be able to leverage Google’s AI and threat intelligence (Mandiant + Chronicle)

- Google Cloud customers will see an improved benefit realization through access to Wiz’s impressive products, potentially at a lower cost or with deeper integration

A few questions to explore:

- Will Wiz remain committed to multi-cloud? Is there a way to get privileged access to Google’s roadmap for Wiz?

- Will Wiz shift from a Software as Service (SaaS) model to a Google Cloud Stock Keeping Unit (SKU)? Will that affect the current budgets? What do existing contracts state?

- Will Wiz’s acquisition restrict vendor neutrality? What alternatives should be considered?

- AWS and Microsoft get a formidable competitor and potentially lose a key partner

- Stronger competition in cloud security: Historically, Microsoft has built its market-leading security business around an enterprise-wide platform approach, covering identity, endpoints, cloud workloads, and more recently AI-driven threat detection. Microsoft Defender, Sentinel, and Azure Security Center offer a broad security fabric that spans beyond cloud to hybrid IT environments. Meanwhile, AWS has taken a deeply integrated, service-native approach to security, embedding security into its ecosystem rather than building an overarching platform like Microsoft. Its focus has been on scalability, automation, and cloud-native controls, with Security Hub, GuardDuty, IAM Access Analyzer, and WAF serving as key components. Through Wiz, Google Cloud is attempting to close critical gaps in its security portfolio and leapfrog its competition

- Losing a key partner: The bigger concern, at least in the short term, for AWS and Microsoft is that Wiz was one of the strongest multi-cloud security partners. Enterprises relied on Wiz’s agentless security model precisely because it worked seamlessly across AWS, Azure, and Google Cloud. Furthermore, Wiz was one of the top-selling security vendors on AWS and Azure marketplaces. Both hyperscalers were actively promoting Wiz through their sales apparatus. However, AWS has largely relied on third-party Independent Software Vendors (ISVs) such as Wiz for advanced multi-cloud security, making this acquisition a direct challenge to its strategy. The acquisition brings uncertainty to this burgeoning partnership. AWS and Microsoft may have to rethink and reset their partnerships with Wiz

- System integrators & Managed Security Service Providers (MSSPs): Current and potential partners of Wiz and Google Cloud

New opportunities:

- The catalog expansion of Cybersecurity services on Google Cloud, offering meaningful upsell & cross-sell opportunities

- Vendor consolidation services arising from the integration of Wiz with existing Google Cloud security solutions such as Chronicle and Mandiant

A few questions to explore:

- What will be the effect on the services based on Wiz combined with one of the other hyperscalers?

- What will be the approach for enterprises preferring independent security stacks?

- How to get early access to Google’s roadmap to Wiz? What will be the strategy for skilling the talent?

Google Cloud’s Wiz move is more than an acquisition—it is a shift in the balance of the cloud security ecosystem. Enterprises will have to adapt, AWS, Microsoft, and other security vendors will have to respond, and service providers will have to rethink their strategies.

If you’d like to hear more about this latest acquisition, please share your thoughts and connect with Shivraj Borade ([email protected]), Zachariah Chirayil ([email protected]), and Kumar Avijit ([email protected]) to discuss the implications and next moves in this shifting ecosystem.