The conversation around Global Capability Centers (GCCs) often revolves around the “art of the possible”—highlighting their transformative potential. However, executives now need to recognize that with great opportunities comes significant challenges.

The global expansion of GCCs has never been more popular. From Davos to the Indian Government’s budget, the GCC industry is finding its space across key forums.

At Everest Group, we track over 8,500 such centers globally and with 1,000+ set-up throughout the last 3 years alone, many with our support, GCCs are on the rise.

Interestingly to note as well, that a large number of centers over the last 3-5 years have been set up by mid-sized companies and are micro/nano centers with less than 100 Full-Time-Equivalents (FTEs). That said, some recent conversations have made me wonder if there is sufficient mindshare given to thinking about the possible negatives of the model. Of course, not to discourage executives from setting up GCCs, but instead to think the process through, in order to ensure they do it for the right reasons and in the right manner.

Reach out to discuss this topic in depth.

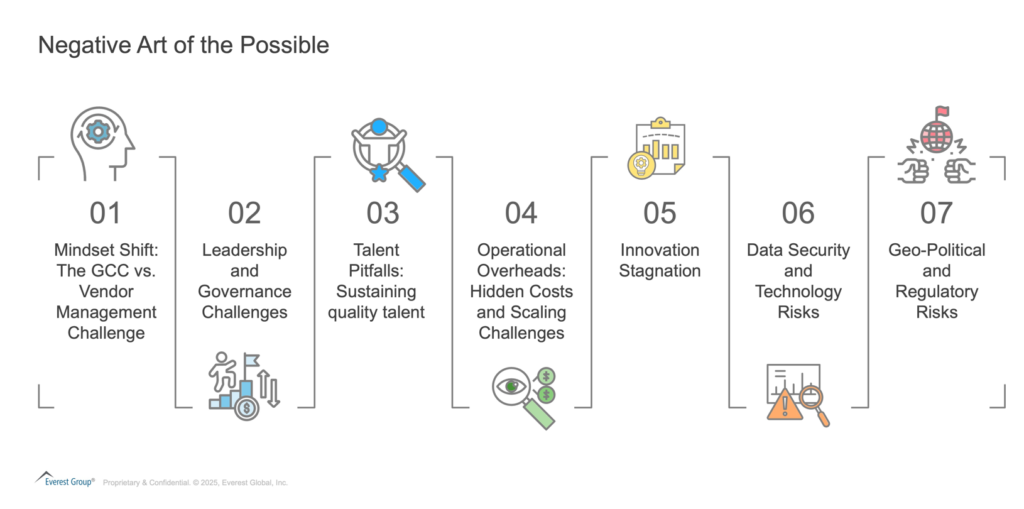

Below is our list of the ‘Negative Art of the Possible’, that executives should be wary of while looking at their GCC strategy.

1. Mindset shift: The GCC vs. vendor management challenge

The GCC requires a different management approach

Managing a GCC is fundamentally different from managing an outsourced vendor. While both models have performance metrics, the enforcement mechanism differs – there is no penalizing one’s own entity. Instead, the focus must be on building shared purpose, alignment, and value creation.

Partner vs. servant mentality

Many organizations struggle with the transition from viewing GCCs as transactional service providers to true strategic partners. If Human Quotient (HQ) leadership continues to treat the GCC as a back-office rather than an integrated business function, its potential remains untapped.

Balancing autonomy and alignment

GCCs must be empowered with decision-making authority while maintaining alignment with enterprise-wide objectives. A lack of clear strategic intent leads to frustration on both sides – GCCs feel underutilized, while HQ leadership sees a limited Return on Investment (ROI).

2. Leadership and governance challenges

Lack of local leadership pipeline

An overdependence on HQ-based leadership prevents local decision-making, slowing agility. Markets like India now offer a sizeable and experienced talent pool, but this is not true for all offshore locations, esp., with more than 300 new GCC setups each year. This not only impacts the ability to find the right leadership but also impacts the ability to retain and grow strong middle-level leadership talent.

Misaligned Stakeholders

Some GCCs struggle with unclear mandates, leading to conflicts with business units. A disconnect between GCC leaders and their Chief Experience Officers (CXO’s) perspective on their role and the value of GCC is more prevalent than desired and causes frustration at both ends.

3. Talent pitfalls: Sustaining quality talent

Skill gaps and talent shortages

Despite large talent pools (or demographic dividend), there are several pockets of scarcity in niche skills and project ready talent in the market. Companies may overestimate the availability of skilled professionals, leading to hiring delays and unplanned training costs. At Everest Group, we have consistently helped companies develop a realistic talent scalability and sustainability assumption into their business plan, and I am always amazed how executives are so surprised when they see the difference in the talent pool vs. hiring potential.

Attrition and wage inflation

Many companies are drawn to locations like India, Poland, or the Philippines, due to their lower labor costs. However, these are highly (and increasingly) competitive markets that experience high attrition rates, sometimes exceeding 15% annually in tech roles and even higher for operations roles. As more companies compete for the same talent pool, wages increase rapidly, eroding the cost advantages.

Cultural disconnects and employee engagement

GCCs must strike a balance between integrating with the global culture and respecting local workplace dynamics. Overlooking this can cause disengagement, lower productivity, and reputational risks.

4. Operational overheads: Hidden costs and scaling challenges

Scaling Complexity

While setting up a small team is easy – most new GCCs can meet hiring targets relatively easily in their first 18-24 months, esp. if they pay some premium over the market. Retaining talent for longer tenures and scaling beyond 300-500 FTEs requires a different employee value proposition strategy, and talent and governance models. Poor planning, or a lack of proactive adjustments, can then create fragmented processes and bottlenecks. Our Top GBS Employers™ in India, the Philippines, and Poland – 2024 research shows that GBS/GCC’s brand perception is volatile and requires continuous readjustments.

Unexpected operational costs

Many GCCs start with aggressive cost-saving targets, but later face unanticipated expenses: real estate, compliance, cybersecurity, and operational inefficiencies. Hidden costs (or underestimated costs) can also erode cost advantages within 3–5 years.

5. Innovation stagnation

Order-taking culture

Without investment in capability building, GCCs risk becoming low-value cost centers instead of innovation hubs. Many mature GCCs have now broken the stereotype, with Everest Group recently identifying and celebrating these companies as part of our collaboration with Nasscom in India. However, the reality remains that less than 10% of GCCs have managed to move to the top tier of maturity states – GBS Evolution Persona

Resistance to change

Some GCCs can also suffer from rigid legacy processes that hinder adaptability to new technologies. Our research shows that more than 60% of ~800 GCCs analyzed have not managed to standardize their processes sufficiently. Furthermore, not all of these are because of a lack of effort. Many GCCs struggle to overcome resistance to change, and while they struggle to deliver on baseline promises, their ability to expand the mandate diminishes. ability to expand the mandate diminishes.

6. Data security and technology risks

Data breaches and privacy violations

GCCs handling sensitive customer data face huge compliance risks if security is not prioritized.

Over-reliance on automation/AI

While automation / artificial intelligence (AI) reduces costs, excessive reliance without governance can result in flawed decision-making and customer dissatisfaction. Further, every wave of automation (Generative AI (gen AI) being the latest) comes along with expectations of rapid, scaled workforce reductions which can be hard to implement and impact operational stability. Our latest Everest Group Reports showed less than 30% of use cases for Generative AI moved beyond the pilot stage, with a very limited impact on the number of FTEs.

7. Geo-political and regulatory risks

Regulatory compliance challenges

GCCs must comply with multiple regulatory frameworks across different jurisdictions. The failure to meet compliance requirements can result in financial penalties, operational disruptions, and reputational damage.

Changing the tax and regulatory landscape

Countries offer tax incentives to attract GCCs, but can also revise them unpredictably at times, impacting long-term viability. Similarly, the landscape (permanent establishment norms, reviewed by tax authorities, regulatory policy changes) can change unexpectedly and impact plans.

Protectionism and nationalism

Political shifts may lead to stricter work visa regulations or local hiring mandates, reducing workforce mobility.

Looking forward: What leaders must now do

I am not writing this article to discourage executives from setting up or scaling up GCCs. On the contrary, I strongly believe that there are only two types of companies in 2025– those who have GCCs and those who will set up GCCs in the future! This model has immense value and has a strategic role in global companies’ capability footprint. Reflecting on the points we have listed above, here are our five callouts for executives looking at GCCs to mitigate these risks, and focus on a balanced approach:

- Adopt a GCC-first mindset – Treat GCCs as strategic partners, not just as an extension of outsourcing

- Think beyond cost savings – Build GCCs as value-driven talent and innovation hubs, not just offshore cost centers

- Develop local leadership – Invest in regional leaders who can drive strategic impact

- Strengthen governance – Define clear roles, mandates, and escalation mechanisms

- Diversify risks – Avoid over-reliance on a single location; multi-hub strategies provide resilience

- Embedded Environmental, Social and Governance (ESG) principles – Focus on sustainable growth, local talent development, and ethical practices

By proactively addressing these challenges, organizations can ensure their GCCs become long-term enablers of success rather than simply sources of unforeseen risk.

If you found this blog interesting, you can also read our recent article on the evolving role of corporate communications in GCCs. If you are interested in discussing how Everest Group can help you further or to speak about these parameters in more depth, please reach out to me ([email protected]).