Ground Station-as-a-Service (GSaaS) or Ground Segment-as-a-Service (GSaaS) providers manage the ground segment infrastructure required to maintain satellite connectivity with the earth as satellites orbit.

With GSaaS, satellite operators can share ground infrastructure and pay based on usage (per pass or per minute), rather than building and maintaining their own satellite ground stations. GSaaS providers also offer additional services such as remote monitoring, data processing, cloud integration, network connectivity, antenna alignment, satellite tracking, maintenance support, and security measures.

Reach out to discuss this topic in depth.

Why GSaaS is gaining traction now?

While limited companies have been offering GSaaS for over a decade now, the landscape has evolved with a growing number of players and an expanded range of services. The following factors are enabling GSaaS to evolve from a niche solution, into a critical enabler of next-generation satellite communications.

- The increasing deployment of small satellite constellations such as Starlink, OneWeb, and Amazon’s Project Kuiper are all key drivers of GSaaS market growth

- 5G Non-Terrestrial Networks (NTN) is integrating satellites into telecom networks and making it essential to manage traffic, optimize latency, and enable seamless handovers

- 6G is expected to bring more specialized GSaaS growth in quantum communications and ultra-high speed data relay demanding more advanced and artificial intelligence (AI)-powered GSaaS platforms

GSaaS current market landscape

Amazon Web Services (AWS) Ground Station, Kongsberg Satellite Services (KSAT), Swedish Space Corporation (SSC), RBC Signals, Leaf Space, ATLAS Space Operations, Infostellar, Dhruva Space, and FOSSA Systems are a few of the prevailing GSaaS providers.

Enterprises like Viasat, Inmarsat, and Telesat operate ground stations, but do not offer GSaaS or associated solutions. On the other hand, enterprises like Kratos Defense and Security Solutions, Cobham, Peraton, Mercury System, and Northrop Grumman Systems focus on delivering advanced technologies and services to support satellite ground operations.

These providers are contributing to the expansion and innovation within the GSaaS market, providing diverse services and GSaaS solutions to meet the growing demands of the satellite industry. At Everest Group, we estimate the total market size of GSaaS worldwide to grow at a compound annual growth rate (CAGR) of 6.5% between 2025 to 2027, however the adoption of 5G NTN and the launch of 6G could significantly boost the CAGR by up to 14% by 2032.

Growth drivers

- GSaaS providers are evolving beyond ground station access into data-driven service providers. They also process, store, and monetize satellite data. Cloud integration (AWS, Azure, and Google Cloud) will drive data-driven insights, allowing GSaaS providers to offer AI-based analytics and intelligence services

- The multi-orbit compatibility with expansion of GSaaS to support Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Equatorial Orbit (GEO) satellites, allows GSaaS providers to serve a broader customer base including commercial, defense, and Internet of Things (IoT) sectors

Growth inhibitors

- Regulatory frameworks, including future region-specific licensing, spectrum policies set by the International Telecommunication Union (ITU) and other governing bodies, may lead to scalability challenges

- Cybersecurity threats are a growing concern, as ground station networks are potential targets for data breaches, signal jamming, and hacking attempts. Blockchain technology is emerging as a potential security solution, however the adoption is still in its early stages

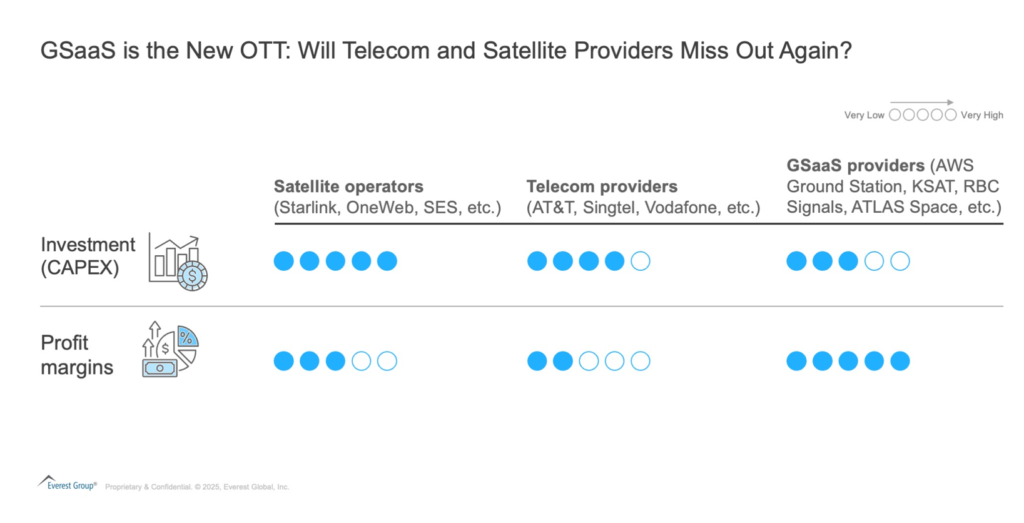

GSaaS providers have the potential to capture greater value than traditional telecom operators and even satellite operators, mirroring the way Over the Top (OTT) platforms surpassed telecom operators in profitability with the following factors:

- Strong pricing power: GSaaS providers benefit from strong pricing power due to the critical role they play as the gateway between space and earth. Satellite companies rely on GSaaS for seamless connectivity, just as telecom operators will increasingly depend on these providers for hybrid connectivity solutions, such as 5G NTN and edge computing.

Industry examples:

- Astrocast uses both KSAT and Leaf Space GSaaS services to maintain service continuity

- SES has partnered with Microsoft Azure to integrate its MEO satellite connectivity with Azure’s cloud services

- Easy scalability: GSaaS providers can scale rapidly without the complex regulatory and infrastructure constraints faced by telecom or satellite operators for each geography. Unlike regional telecom players bound by spectrum licensing, GSaaS providers can expand their footprint globally, offering services to multiple satellite operators and government agencies without extensive regulatory hurdles.

Industry example:

- KSAT operates over 270 antennas across 26 locations, supporting multi-orbit constellations (LEO, MEO, GEO) with a global coverage network, unlike traditional telecom providers with regional restrictions

- Value-added services and data monetization: GSaaS providers are well-positioned to expand revenue streams through cloud-based data analytics, AI-powered processing, and real-time data distribution. Unlike traditional satellite data processing, which involves time-consuming manual analysis, GSaaS enables instant AI-driven insights, improving decision-making speed across industries.

Industry examples:

- Microsoft Azure Orbital integrates satellite data with AI and cloud services, unlocking real-time applications for agriculture, defense, and climate monitoring

- AWS Ground Station integrates directly with AI / Machine Learning (ML) tools on AWS, enabling real-time satellite data processing

- KSAT and ATLAS Space Operations are expanding their services to include data analytics and cloud-native insights, enhancing the value proposition for satellite customers

Here is a side-by-side comparison on why GSaaS has the potential to generate more profitability than satellite and telecom operators.

Example of a revenue model for GSaaS providers offering subscription-based services:

- Basic: Pay-per-use satellite data downlink

- Premium: AI-powered insights for industries (weather, maritime, defense, oil / gas industry, remote mining, etc.,)

- For enterprises: End-to-end satellite data pipeline + cloud storage + real-time AI analytics

What can telecom providers and satellite operators do to grab this monetization opportunity?

Traditional telecom operators own the infrastructure but had missed opportunities with content streaming (OTT players) and digital payments (FinTech super apps). As new competition and opportunities are available in the market, telecom operators should expand into GSaaS and satellite communication to provide enterprise-grade connectivity beyond fiber and 5G.

- GSaaS providers can have strategic partnerships with telecom and satellite operators to offer unique, bundled services, more than just connectivity. They can achieve this through strategic partnerships with satellite providers like Starlink and OneWeb to offer hybrid telecom solutions

- A shift to value-based pricing including services like data analytics can help the emergence of new business models for the operators. As we move towards 6G, the communication industry is poised for a significant transformation, with telecom operators evolving into technology-driven entities

- Satellite operators can explore monetizing spectrum licensing by leasing it to GSaaS providers and expanding into direct-to-enterprise connectivity, creating a Business-to-Business (B2B) revenue stream, by offering tailored satellite communication solutions to businesses

Industry examples:

- AT&T and T-Mobile have partnered with SpaceX for direct-to-device satellite communication, ensuring continuous coverage and reducing the risk of losing customers to standalone satellite providers

- In August 2024, Eutelsat initiated the creation of a ground station-as-a-service company by selling 80% of its teleport service business

- Viasat and Inmarsat generate revenue through spectrum licensing and satellite ground infrastructure leasing to other satellite networks

Implications for GSaaS providers

The GSaaS market is on the brink of exponential growth, driven by the convergence of 5G NTN, AI, cloud computing, and the rising demand for satellite connectivity. GSaaS providers will transition beyond mere ground station access into intelligent data hubs, offering real-time AI-powered analytics, automated data processing, and cloud-integrated solutions.

A major growth enabler will be through active collaborations with cloud services for end-to-end data processing and analytics solutions, develop niche services tailored to specific industries like maritime, aviation, and remote sensing.

As security challenges intensify with this growing adoption, GSaaS providers will have to invest in blockchain, encryption, and secure cloud frameworks too. AI-driven predictive analytics, autonomous satellite scheduling, and automated spectrum management will become critical for optimizing operations and reducing costs for the GSaaS providers.

GSaaS providers that prioritize AI, cloud integration, cybersecurity, and industry-specific solutions will lead the market, shaping the future of space-based connectivity and data intelligence.

At Everest Group, we run dedicated coverage on telecom, network services and 5G, by providing in-depth insights and analysis of industry trends, technologies, and innovations.

If you found this blog interesting, check out our From Leakage To Leverage: How Blockchain Can Transform Telecom Revenue Streams | Blog – Everest Group, which delves deeper into another topic regarding the telecoms sector.

If you have any questions or would like to gain expertise in how to leverage blockchain technology and attain full potential for your business or would like to reach out to discuss these topics in more depth, please contact Titus M at titus.m@everestgrp.com or Nithya.S at nithya.s@everestgrp.com for more details.