The Middle East has traditionally resisted outsourcing due to a strict regulatory environment and reliance on local providers. However, this is changing as financial institutions seek third-party providers to meet growing technological, operational, and transformation demands. Additionally, governments are also fostering global service centers to diversify economies and drive digitalization.

This blog explores how evolving regulations, market trends, and strategic partnerships are now creating new outsourcing opportunities in the Middle East.

Reach out to discuss this topic in depth.

Evolving regulations: the Middle East’s path to outsourcing formalization

The regulatory landscape in the Middle East has undergone significant transformation over the years, with key developments led by the Central Bank of the UAE (CBUAE) and the Saudi Arabian Monetary Authority (SAMA).

- CBUAE’s Outsourcing Regulations:

The UAE’s regulations strike a balance between innovation and oversight, requiring banks to conduct thorough due diligence, risk management, and continuous monitoring for material outsourcing arrangements

- SAMA’s Regulations:

SAMA’s framework aligns with CBUAE but includes Saudi-specific provisions. Banks must obtain SAMA’s no-objection approval before outsourcing to overseas providers, ensuring compliance with data security and regulatory mandates.

These frameworks reflect a broader push towards formalizing outsourcing while maintaining strong regulatory safeguards.

Market dynamics: Trends in Middle Eastern outsourcing

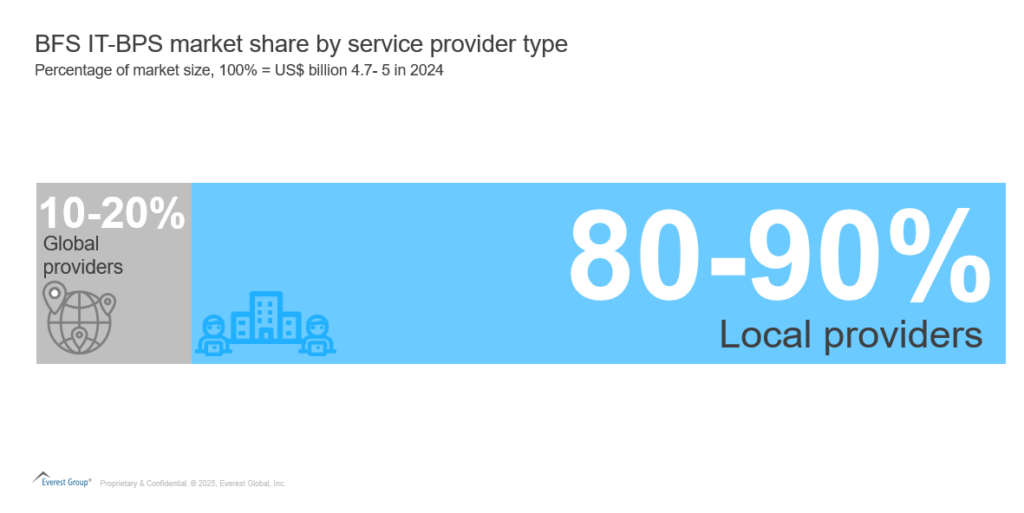

Local providers dominate the Information Technology (IT)-Business Process Outsourcing (BPO) services market, holding a market share of close to 80%, as providers enjoy greater trust from both the government and private sector, given the perception that local providers understand the market and client needs better.

A few characteristics, which define the Middle Eastern outsourcing market are:

- Localization by government: More than 90% of the contracts from government/public sector enterprises are usually awarded to local players, even if the cost is higher than the global providers, to boost national economy, promote local employment, ease of ensuring adherence to regulatory frameworks, and strengthen strategic partnerships for sustainable development in the region. A key example of this is Cognizant’s partnership with Upsource, a UAE-based firm, to enhance business process transformation and digital services in the region

- Global players winning private sector contracts: Private enterprises in the region prioritize cost efficiency and the adoption of global best practices and solutions, making them more inclined to outsource IT-BP services to global providers, as compared to public sector enterprises. Nearly 30-40% of the IT-BPS contracts from private enterprises are awarded to global players

- Subcontracting to global players: Some local providers are subcontracting specific parts of processes to global providers for domain expertise and mitigating workforce challenges for specialized services

- Rise of nearshore hubs: Countries like Egypt, Jordan, Morocco, and Tunisia are emerging as low-cost nearshore outsourcing centers, attracting global service providers

Unlocking value: market size and deal trends for outsourcing providers in the Middle East

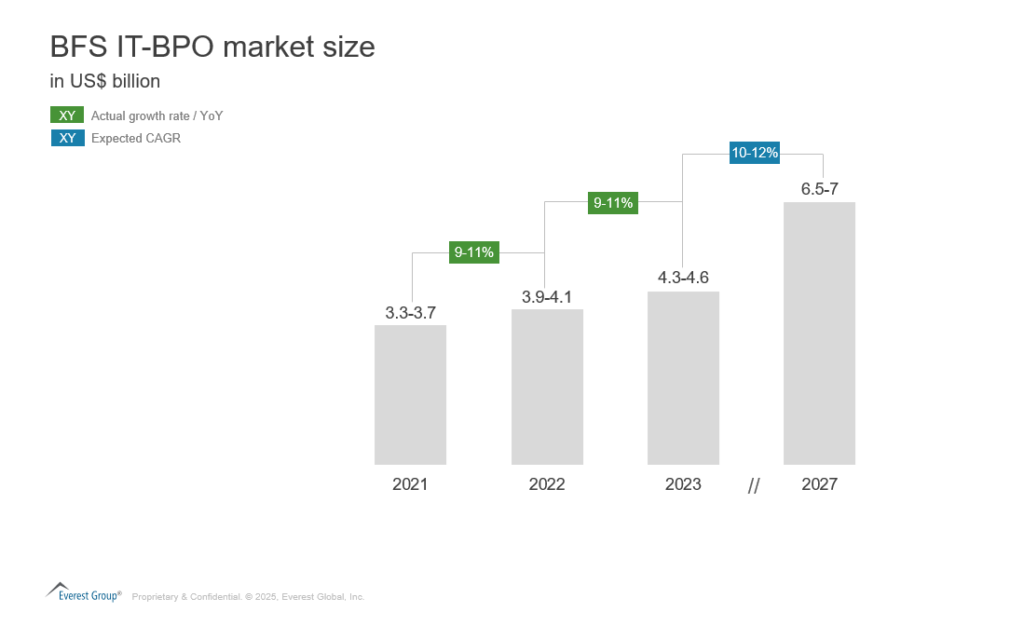

The overall BFS IT-BP outsourcing market was valued at US$4.3-4.6 billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 10-12%, and is projected to reach US$6.5-7 billion by 2027. IT outsourcing accounts for 80-90% of the market, with the remainder driven by BPS.

The BFS sector in the Middle East is concentrated within the UAE, Saudia Arabia, Israel, South Africa, and Qatar accounting for close to 85% of the total banking assets in the region.

- Growth in the region is being driven by a rising demand for lending products amidst overall economic expansion in the region. As wealth management gains prominence among top banks and more international and independent firms enter the region, there is a swift expansion of investment products and comprehensive advisory solutions, including wealth and legacy planning. State Street Global Advisors, the fourth-largest asset manager in the world, is doubling its resources in the Africa and Middle East region, expanding its hubs in the UAE and Saudi Arabia to achieve the company’s growth ambitions in the broader region, its president recently Yie-Hsin Hung said

- Banks in the Middle East are slowly embracing core transformations to upgrade outdated systems with modern, agile technologies. Moreover, Generative AI (gen AI) offers the potential for highly personalized banking services, but it also introduces challenges related to data management and regulatory compliance. A leading service provider has signed a strategic agreement with the Commercial Bank of Dubai (CBD), in order to drive its technology transformation program, powered by hyper automation and gen AI solutions. Mashreq has also initiated a strategy to modernize its core systems globally, aiming for open, modular, and scalable solutions through infrastructure updates, as an example, the use of Oracle’s Exadata Cloud@Customer (ExaCC) for database workloads to achieve scalability and agility

- Further, there is a rising emphasis on regulatory oversight, including ongoing implementation of Basel IV regulations. Implementation of IFRS 17 would require much stricter reporting and stricter standards, which is likely to increase operational costs for financial institutions

- The Middle East and North Africa (MENA) region is seeing growing regulatory support for open banking and digital payments. The Central Bank of Dubai partnered with an India-based provider to boost digital payments and embedded finance in the UAE. SAMA also launched its Open Banking Lab in 2023 to support Vision 2030, offering a sandbox for corporate and retail use cases. Bahrain pioneered the region’s first onshore regulatory sandbox, enabling open banking testing. Meanwhile, CBUAE is developing a Financial Infrastructure Transformation Program for implementation by 2026

Navigating the path forward

The Gulf Cooperation Council (GCC) banking sector is on the brink of a digital transformation, driven by advancements in generative artificial intelligence, industry convergence, embedded finance, open data, digital currencies, and digital identity solutions, all of which are poised to reshape the landscape.

Sustainability has emerged as a key focus for financial institutions. This is evident in the UAE banking sector’s recent commitment to mobilize US$270 billion in green finance by 2030, highlighting the region’s dedication to sustainable growth and environmental responsibility.

The creation of the Dubai Outsourcing City has attracted several providers to set up an outsourcing base in the region, offering integrated support centers, call centers, data centers and warehouses. For service providers and enterprises, countries such as Morocco, Algeria, Egypt, Jordan, Tunisia, etc. are also emerging as low-cost nearshore centers.

As the growth of the Middle Eastern outsourcing market outpaces most of the mature markets, providers who are willing to co-invest, have access to specialized talent, and are able demonstrate local presence, to name a few, would be able to make in-roads in this market.

As the Middle East’s outsourcing landscape evolves rapidly, staying ahead of regulatory shifts, market trends, and emerging opportunities is crucial. Connect with Everest Group to gain deeper insights, benchmark against industry best practices, and develop winning strategies for this dynamic market.

If you found this blog interesting, check out our The Region Aspiring To Be The Next AI Innovation Superpower | Blog – Everest Group, which delves deeper into another topic regarding the evolving landscape of the Middle East.

If you have any questions or would like to discuss these topics in more detail, feel free to contact Rahul Mittal ([email protected]) or Sahil Chaudhary ([email protected]).