The demand for Payments Business Process Services (BPS) continues to surge as enterprises navigate intensifying cost pressures, growing compliance complexities, and shifting customer expectations.

While real-time payments adoption accelerates across global markets, the core needs of traditional buyers (e.g., issuing banks, acquiring banks, card networks) remains central to the Payments BPS growth story. Simultaneously, new buyer segments – ranging from healthcare providers to travel platforms – are emerging, bringing fresh opportunities and unique outsourcing requirements.

In this second installment of our three-part series, we explore how Payments BPS providers are adapting to serve both established and adjacent industry buyers, highlighting the variety of processes that each segment is looking to outsource. We also discuss recent market deals and trends that underscore the evolving scope of Payments BPS.

Reach out to discuss this topic in depth.

Traditional buyers: Their expanding need for Payments BPS

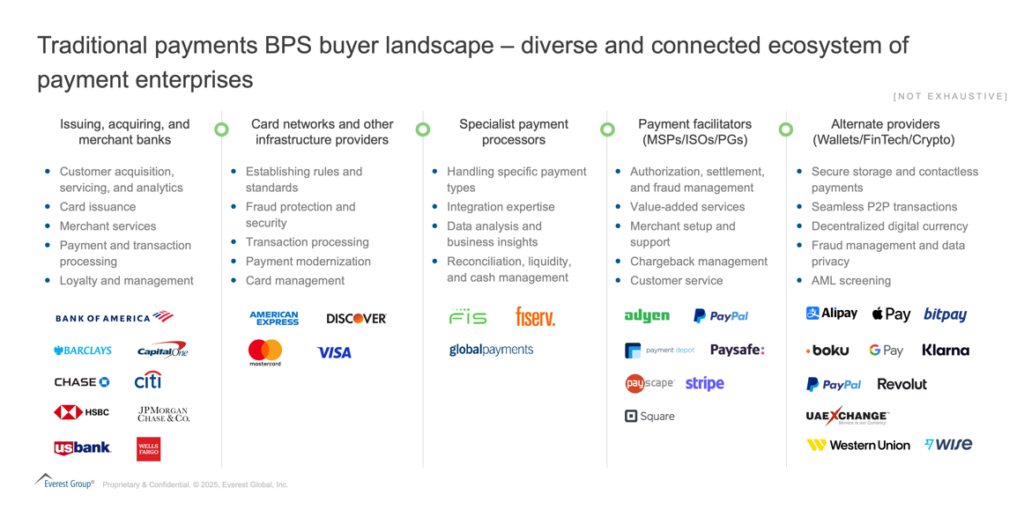

Conventional buyers – such as issuing banks, acquiring banks, card networks, and PayTechs – continues to anchor Payments BPS demand. Historically, much of this outsourcing centered on Financial Crime Compliance (FCC) processes (e.g., KYC, AML, sanctions screening), but the scope is widening.

Exhibit 1: Traditional payments BPS buyer landscape – diverse and connected ecosystem of payment enterprises

Key outsourcing drivers among traditional buyers include:

Volume spikes from real-time payments

- As real-time payments proliferate, banks and card networks grapple with 24/7 operations, instant settlements, and tighter reconciliation windows

- BPS providers step in to manage these high-volume back-office tasks (settlement, reconciliation, exception handling) at scale

Operational efficiency and cost control

- Legacy systems, coupled with the need to handle increasing transaction volumes, push banks and acquirers to outsource mid- and back-office functions

- Processes such as dispute resolution, merchant onboarding, and chargeback management are prime candidates for BPS solutions, freeing up internal teams for strategic initiatives

Evolving compliance mandates

- Beyond Anti-Money Laundering (AML) and sanctions screening, local data protection laws, Payment Card Industry Data Security Standard (PCI-DSS) compliance, and cross-border licensing requirements add complexity

- BPS providers offer domain expertise and shared infrastructure to ensure compliance with minimal capital expenditure

Focus on innovation

- Traditional payment enterprises increasingly see themselves as product and customer experience innovators

- Outsourcing non-core back-office tasks – e.g., document verification, settlement exceptions – allows them to channel resources into new products, Application Programming Interface (APIs), and user interfaces

Exhibit 2: Payments BPS outsourcing intensity by buyer type and process

Emerging opportunities in adjacent industries

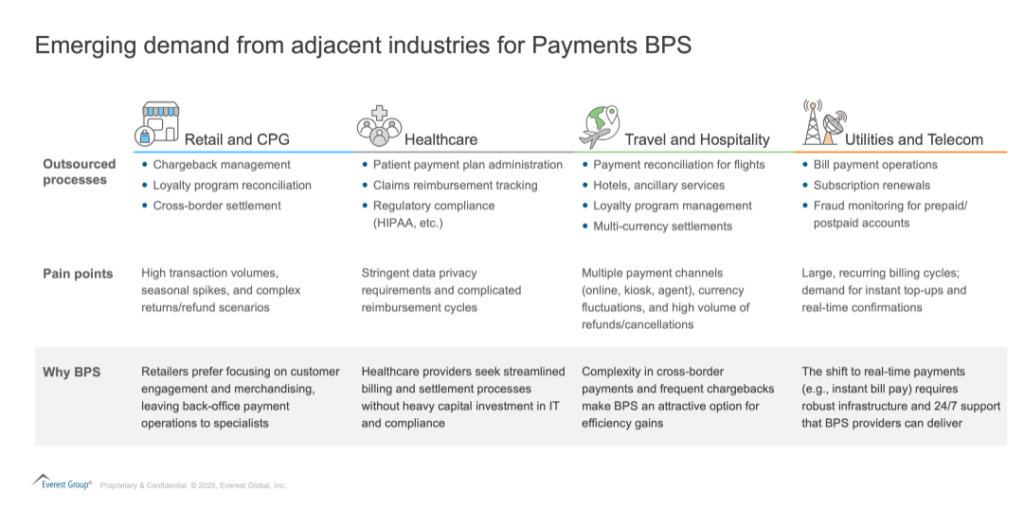

While traditional buyers still dominate Payments BPS, new industry segments – ranging from retail to healthcare – are embedding payment capabilities and outsourcing complex back-office tasks. Many of these sectors lack the deep operational expertise or large-scale infrastructure found in banks, making BPS a compelling solution.

Exhibit 3: Emerging demand from adjacent industries for Payments BPS

Key takeaways

Payments BPS is no longer confined to FCC; it now spans a broader range of back-office processes, driven by the rise of real-time payments, cost pressures, and regulatory complexity.

Traditional buyers – banks, card networks and acquirers – are expanding their outsourcing portfolios to include dispute resolution, merchant onboarding, reconciliation, and more.

Emerging verticals – retail, healthcare, travel and utilities – are seeking BPS solutions to handle specialized payment processes without sacrificing the focus on their core operations.

BPS providers that combine robust compliance expertise with industry-specific knowledge and advanced technology capabilities are best positioned to capitalize on these expanding opportunities.

In the final blog of our series, we will explore how BPS providers are refining their go-to-market strategies, through advisory capabilities, technology investments, and ecosystem partnerships – to stay ahead of this rapidly evolving market. Stay tuned!

If you found this blog interesting, check out our Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group, which delves deeper into another topic regarding the banking sector.

For an in-depth analysis of payment trends, explore our latest reports:

For insights from our Payments BPS experts or to schedule a consultation, connect with Ronak Doshi ([email protected]), Suman Upardrasta ([email protected]), Ritwik Rudra ([email protected]), and Rahul Mittal ([email protected]).

Stay tuned for the upcoming launch of our inaugural Payments Operations Services PEAK Assessment 2025, set to release next quarter.