The Trust and Safety (T&S) industry experienced significant shifts last year. These shifts were due to a sharp rise in egregious content volumes, particularly during elections, new regulations requiring nuanced compliance strategies, and increased enterprise generative AI adoption. As a result, enterprise demand for specialized content moderation, data annotation and labeling, AI safety services, and other value-added solutions increased, but the demand for traditional moderation services matured.

Enterprises now expect T&S service providers to meet evolving enterprise requirements and become strategic enablers by delivering comprehensive T&S solutions and supporting responsible AI deployment, content policy development, and regulatory compliance efforts. The current T&S service provider landscape includes IT/BPO firms, CXM providers, and niche specialists, each bringing their expertise to address enterprise T&S concerns. Providers are building proprietary solutions, expanding operations in talent-rich regions, and increasing investments in AI safety. Additionally, they leverage partnerships with technology firms to enhance T&S solutions across the value chain.

-

Trust and Safety Services PEAK Matrix® Assessment 2025

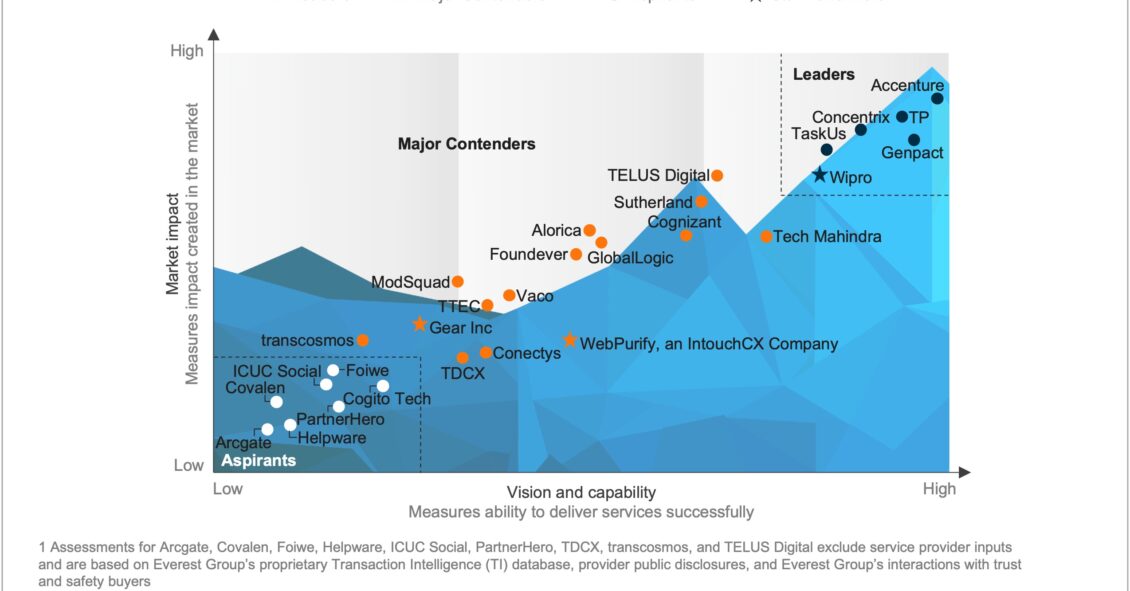

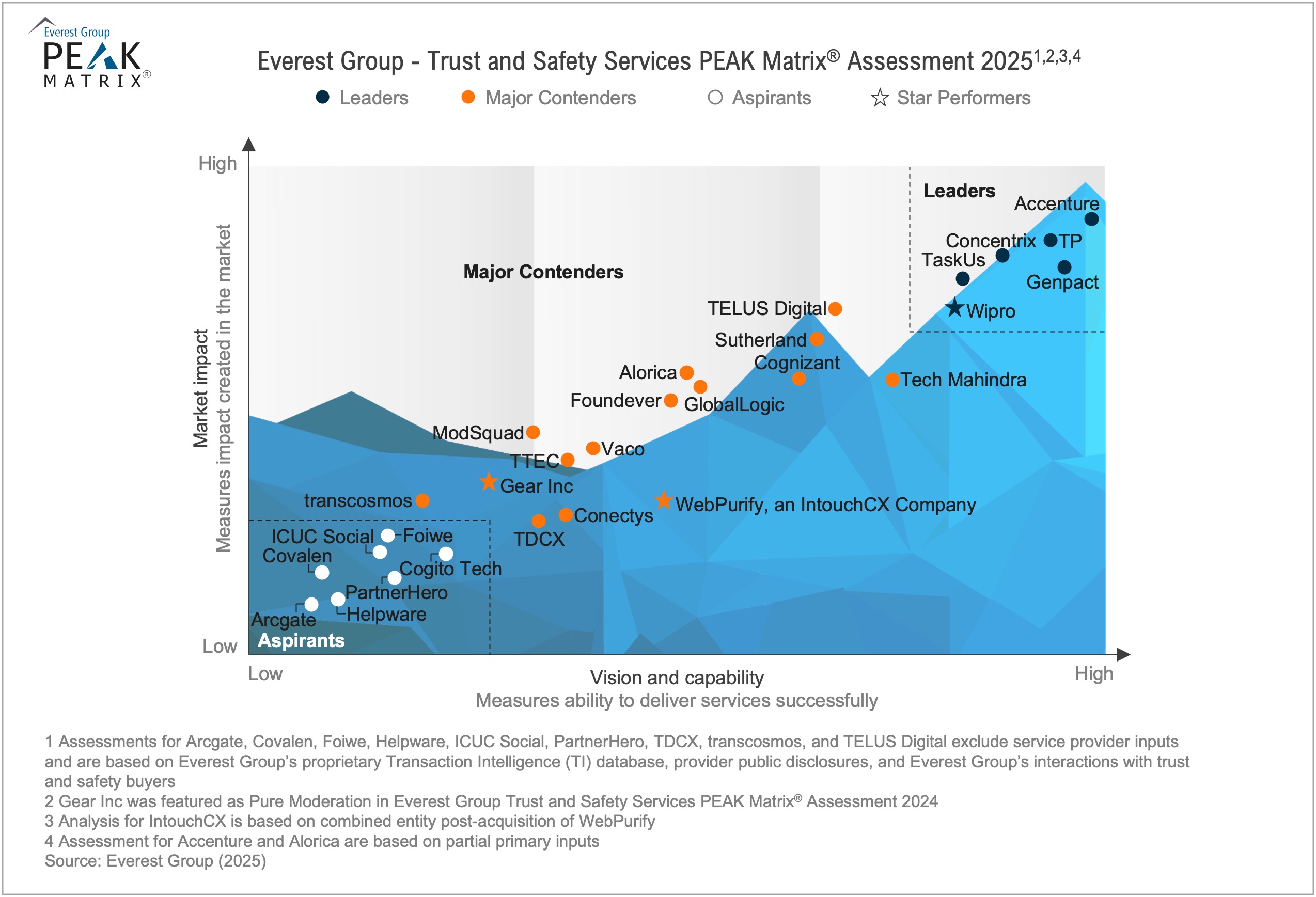

In this report, we assess 28 T&S service providers’ capabilities. Each profile includes the provider’s key strengths and limitations. The report enables buyers to choose the right-fit provider based on sourcing considerations.

Scope

- All industries and geographies

- This assessment is based on Everest Group’s annual RFI process for the calendar year 2025, interactions with leading T&S service providers, client reference checks, and an ongoing analysis of the T&S market

Contents

In this report, we:

- Evaluate 28 leading T&S service providers

- Assess the T&S landscape

- Compare providers’ key strengths and limitations

READ ON -

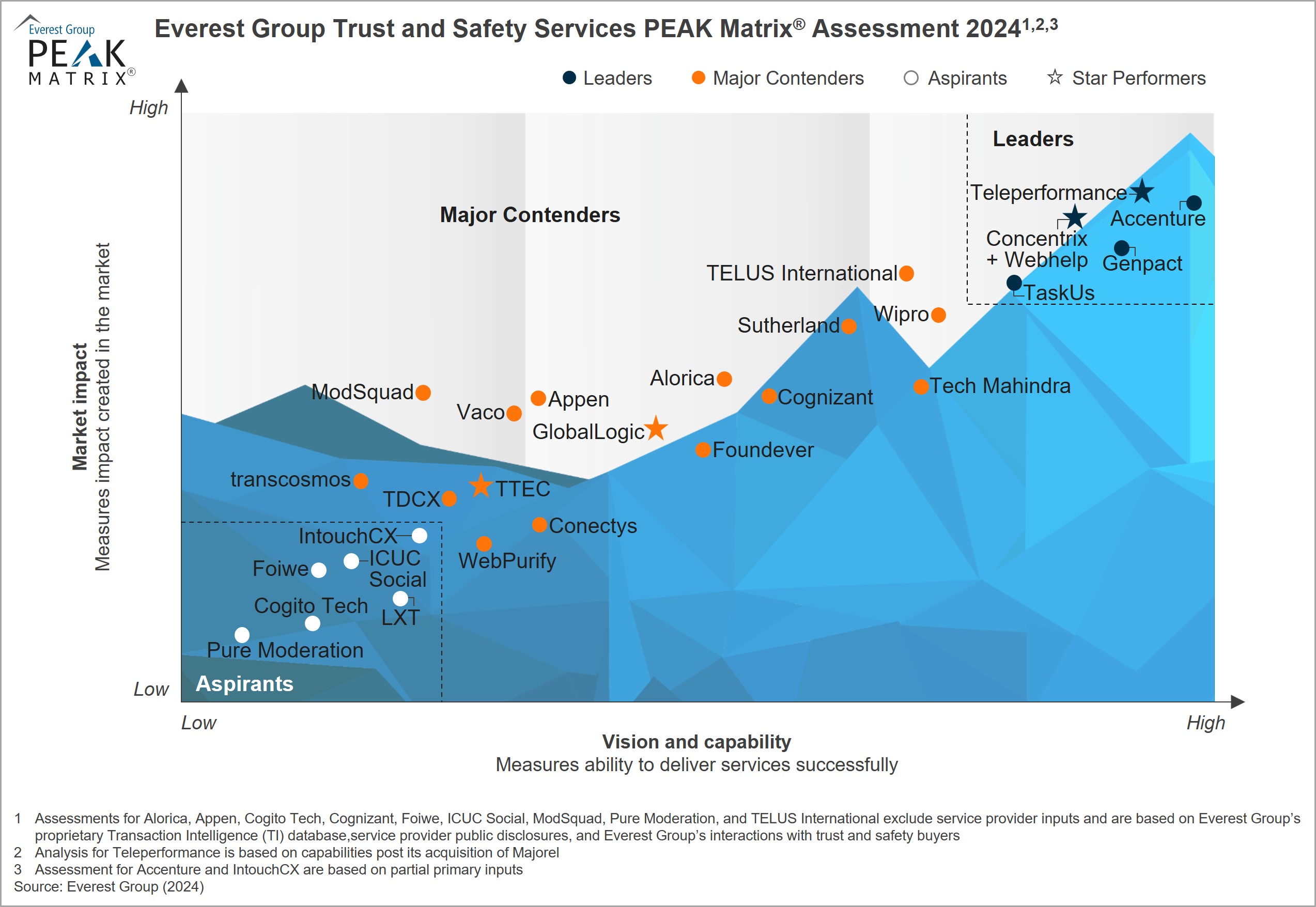

Trust and Safety Services PEAK Matrix® Assessment 2024

In this report, we assess 27 T&S service providers and position them on the Trust and Safety Services PEAK Matrix® as Leaders, Major Contenders, and Aspirants. Each provider profile offers a comprehensive picture of its key strengths and limitations. The study will enable buyers to choose best-fit providers based on their sourcing considerations.

Scope

- All industries and geographies

- This assessment is based on Everest Group’s annual RFI process, interactions with leading T&S service providers, client reference checks, and ongoing analysis of the T&S market

Contents

In this report, we examine:

- Everest Group’s PEAK Matrix® evaluation of 27 leading T&S service providers

- The competitive landscape of the T&S space

- Providers’ key strengths and limitations

READ ON

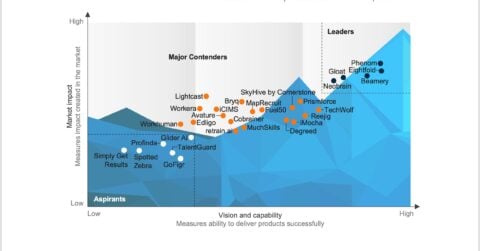

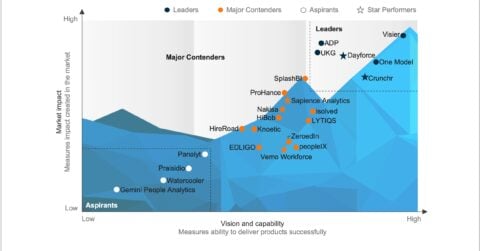

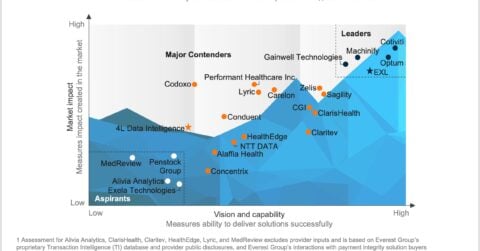

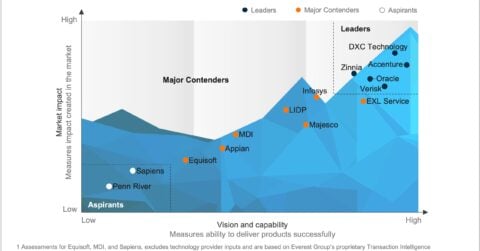

What is the PEAK Matrix®?

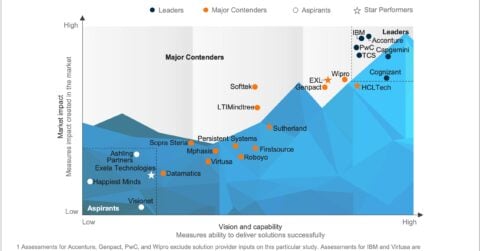

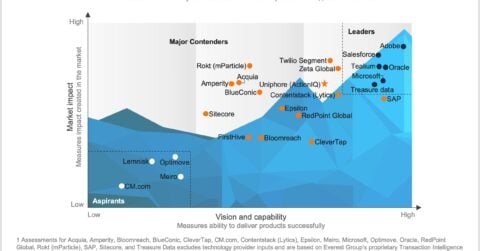

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.